Let me first re-post something I'd put up earlier.

If It Looks Like A Bubble, And Quacks Like A Bubble ...Ouch. "[I]f you closed your eyes and walked 100 feet, you’d bump into three companies selling systems to reduce hospital re-admissions."

Todd Hixon, Forbes

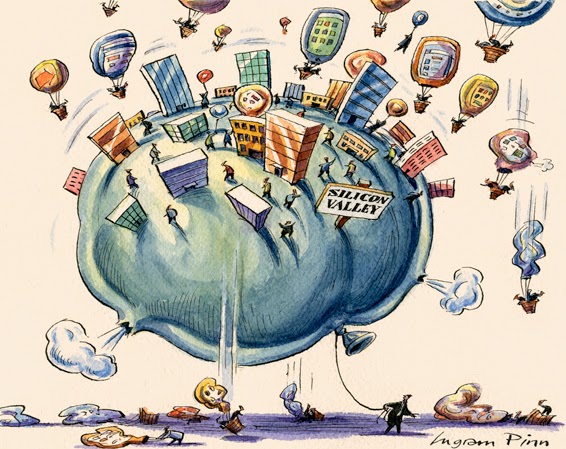

Then it’s best not to build your house on it. Silicon Valley sure looks like a bubble to me, and many others think so too. While these are heady times, it’s actually very difficult to start new investments. Some back-to-basics thinking is the best way to mitigate the risk.

I spent several days at a conference in Silicon Valley recently and then visited venture capital friends on Sand Hill Road. The venture capital market there is dramatically different from the rest of the U.S., even New York, which is having a good run...

At the Health 2.0 conference, which I attended, there was much moxie on display, including a digital health wearables fashion show complete with a runway and a custom music mix. I heard comments, however, that digital health investors are starting to see a lot of me-too offerings: if you closed your eyes and walked 100 feet, you’d bump into three companies selling systems to reduce hospital re-admissions.

Many VCs are wondering, how do you invest into this market with a decent chance of success? If you are chasing the companies that have visibly achieved “escape velocity” in their markets, you are competing with the great names and greater check books. Only a handful can succeed in that game. And then you pay a price based on perfection and bet on continuation of aggressive growth financings and a hot IPO market.

If you play at the seed level, you compete with the host of angels, accept weak terms, and invest in companies in which entrepreneurs may be on their own because seed investors often can’t help, don’t spend the time, or lack governance levers when the going gets tough. And occasionally the big funds reach down and take over an early financing with a big check at a high price, squeezing other investors out. One VC blogger calls this a “piggy round”.

Burn rates are running $500k to $1 million per month and up, in many cases (more). This presumes the ability to keep financing on favorable terms. If not, the blood quickly gets ankle-deep.

This market dynamic looks delicate to me. While the Internet continues to grow and entrepreneurs keep finding new opportunities, the sources of money fueling much of the boom are fickle. The scope of the hot segments market is narrow: largely confined to Silicon Valley and a half-dozen sectors. If the end comes fast, many companies will quickly be in mortal jeopardy: burn rates, valuations, and capital structures will be crushed...

How much Built-to-Flip VC stuff is going on in health tech? What of the economics of all this? Couple of Connecting-Some-Dots items. First, also from Forbes:

Is Strategy Dead? 7 Reasons The Answer May Be Yes

Rick Smith

I am an ex-strategy consultant. I have an MBA. And I am increasingly convinced the relevancy of both has been permanently diminished. Is strategy dead?

Webster’s defines Strategy as “a careful plan for achieving a particular goal over a long period of time.” Yet today, what constitutes a long period of time? 10 years? Or 9 months?! Well thought out plans, or even the objectives that they are built around seem destined to be revisited every one or two quarters. And those who are careful are increasingly vulnerable to those who are agile.

However you debate the semantics, there are several major shifts that have occurred which are rapidly diminishing the relevance of business strategy and strategic planning:

Incrementalism has been disrupted by disruption.

Innovation in most organizations can best be described as “trained incrementalism.” Managers throw buzzwords around like “out of the box thinking” and “paradigm shifts”, but when pressed to deliver, quickly retrench and focus on efforts that are merely incremental. Generating 1-2% improvements is like lining up sandbags in front of an impending tsunami. Someone please show me a single Taxi company strategic plan that anticipated Uber virtually wiping out a century-old industry.

Disruption is coming to a company near you.

Most organizations are not prepared for this, or even preparing for it. Innovation is occurring with high variance outcomes. Traditionally, a strategic risk assessment goes something like this; identify the four most likely competitive or market outcomes, and create a plan for each. The beloved 2×2 matrix to the rescue! But innovations today are not shaking up market share, they are creating and destroying markets entirely. Peering into the future, there are simply far too many possible outcomes to anticipate, let alone plan for comprehensively.

The past is no longer a good predictor of the future.

Company behavior has changed: the average life expectancy of a Fortune 500 company has dropped from more than 80 years to less than 15 in the last century. Consumer behavior has changed: the aging baby-boomers are not acting like the elderly of previous generations. Babies today leave the hospital with a blanket, an iPhone, a Facebook page and a Twitter handle. #OMG. If we do not study history, we are doomed to repeat it. Unless, of course, history stops repeating altogether.

Competitive lines have dissolved completely.

Start-ups are successfully competing with established technology companies are competing with product companies are competing with big data companies. Strategists have long benefited from organized, narrow views of competitive sectors, highlighting the strengths and weaknesses of a discrete group of companies.

Yet this approach is increasingly myopic. Monday’s competition may likely come from a known competitor in your defined segment. Friday, you will be disrupted by a company from a sector you never even saw coming.

Information has gone from scarcity to abundancy.

Much of the value of strategy planning and consulting has been derived from the possession of scarcely available information. But today, information is abundant. Knowledge is transparent. The critical organizational need has shifted from identifying scarce information to quickly assimilating mass information and deftly acting upon it.

It is very difficult to forecast option values.

Let’s say a company wants to open a new factory. Strategists detail the expected costs and revenues, and determine if the project is worth the investment. But how do you forecast the Internet of Things? How much will Big Data cost you, or be worth?

Nothing? Or so much that your organization becomes irrelevant? At this point, the actual outcomes of these investments are wild guesses at best. Yet most companies are anteing up – afraid that the price of sitting on the sidelines may be catastrophic. Everyone seems to be stepping on the gas despite the headlights growing increasingly dim.OK, drum roll... Some of the following may well seem absurdly heretical and counterintuitive, but you really need to read the entire book. When I saw this touted by Nicholas Nassim Taleb, I just had to get it. Wonderfully written and argued.

Large scale execution is trumped by rapid transactional learning.

Need to trim $1 billion in expenditures? Launch a massive Six Sigma project across the entire organization over a five year period, and the results are fairly predictable. Ah, the good ole’ days! Unfortunately, today’s leaders do not have the luxury of executing a prescribed strategy over a long period of time. Rather, they must build a pervasive capability of rapid transactional learning. Assimilate what is changing quickly. Push decision making toward the customer. Today’s game of business looks a lot less like Chess, and a lot more like hockey. Don’t worry about planning four or five moves out, just get quickly to where the puck is going. Sorry, there are no timeouts.

In the end, your company’s strategy is nothing more than the collective actions of all of your employees, and these actions are being guided less by strategies thoughtfully crafted within wood paneled conference rooms, and more by speed, unpredictability and sweeping change occurring on a dynamically evolving battlefield.

The language of Strategy may be alive and well within the musings of corporate planners and external consultants.

Unfortunately, the marketplace is no longer paying attention.

4. THE IDEOLOGY OF COMPETITION

CREATIVE MONOPOLY means new products that benefit everybody and sustainable profits for the creator. Competition means no profits for anybody, no meaningful differentiation, and a struggle for survival. So why do people believe that competition is healthy? The answer is that competition is not just an economic concept or a simple inconvenience that individuals and companies must deal with in the marketplace. More than anything else, competition is an ideology— the ideology— that pervades our society and distorts our thinking. We preach competition, internalize its necessity, and enact its commandments; and as a result, we trap ourselves within it—even though the more we compete, the less we gain.

This is a simple truth, but we’ve all been trained to ignore it...

3. RUTHLESS PEOPLE

The competitive ecosystem pushes people toward ruthlessness or death.

A monopoly like Google is different. Since it doesn’t have to worry about competing with anyone, it has wider latitude to care about its workers, its products, and its impact on the wider world. Google’s motto—“ Don’t be evil”— is in part a branding ploy, but it’s also characteristic of a kind of business that’s successful enough to take ethics seriously without jeopardizing its own existence. In business, money is either an important thing or it is everything. Monopolists can afford to think about things other than making money; non-monopolists can’t. In perfect competition, a business is so focused on today’s margins that it can’t possibly plan for a long-term future. Only one thing can allow a business to transcend the daily brute struggle for survival: monopoly profits.

MONOPOLY CAPITALISM

So, a monopoly is good for everyone on the inside, but what about everyone on the outside? Do outsized profits come at the expense of the rest of society? Actually, yes: profits come out of customers’ wallets, and monopolies deserve their bad reputation— but only in a world where nothing changes.

In a static world, a monopolist is just a rent collector. If you corner the market for something, you can jack up the price; others will have no choice but to buy from you. Think of the famous board game: deeds are shuffled around from player to player, but the board never changes. There’s no way to win by inventing a better kind of real estate development. The relative values of the properties are fixed for all time, so all you can do is try to buy them up.

But the world we live in is dynamic: it’s possible to invent new and better things. Creative monopolists give customers more choices by adding entirely new categories of abundance to the world. Creative monopolies aren’t just good for the rest of society; they’re powerful engines for making it better.

Even the government knows this: that’s why one of its departments works hard to create monopolies (by granting patents to new inventions) even though another part hunts them down (by prosecuting antitrust cases). It’s possible to question whether anyone should really be awarded a legally enforceable monopoly simply for having been the first to think of something like a mobile software design. But it’s clear that something like Apple’s monopoly profits from designing, producing, and marketing the iPhone were the reward for creating greater abundance, not artificial scarcity: customers were happy to finally have the choice of paying high prices to get a smartphone that actually works.

The dynamism of new monopolies itself explains why old monopolies don’t strangle innovation. With Apple’s iOS at the forefront, the rise of mobile computing has dramatically reduced Microsoft’s decades-long operating system dominance. Before that, IBM’s hardware monopoly of the ’60s and ’70s was overtaken by Microsoft’s software monopoly. AT& T had a monopoly on telephone service for most of the 20th century, but now anyone can get a cheap cell phone plan from any number of providers. If the tendency of monopoly businesses were to hold back progress, they would be dangerous and we’d be right to oppose them. But the history of progress is a history of better monopoly businesses replacing incumbents.

Monopolies drive progress because the promise of years or even decades of monopoly profits provides a powerful incentive to innovate. Then monopolies can keep innovating because profits enable them to make the long-term plans and to finance the ambitious research projects that firms locked in competition can’t dream of.

So why are economists obsessed with competition as an ideal state? It’s a relic of history. Economists copied their mathematics from the work of 19th-century physicists: they see individuals and businesses as interchangeable atoms, not as unique creators. Their theories describe an equilibrium state of perfect competition because that’s what’s easy to model, not because it represents the best of business. But it’s worth recalling that the long-run equilibrium predicted by 19th-century physics was a state in which all energy is evenly distributed and everything comes to rest— also known as the heat death of the universe.

Whatever your views on thermodynamics , it’s a powerful metaphor: in business, equilibrium means stasis, and stasis means death. If your industry is in a competitive equilibrium, the death of your business won’t matter to the world; some other undifferentiated competitor will always be ready to take your place.

Perfect equilibrium may describe the void that is most of the universe. It may even characterize many businesses. But every new creation takes place far from equilibrium. In the real world outside economic theory, every business is successful exactly to the extent that it does something others cannot. Monopoly is therefore not a pathology or an exception. Monopoly is the condition of every successful business.

Tolstoy opens Anna Karenina by observing: “All happy families are alike; each unhappy family is unhappy in its own way.” Business is the opposite. All happy companies are different: each one earns a monopoly by solving a unique problem. All failed companies are the same: they failed to escape competition.

1. STARTUP THINKING

New technology tends to come from new ventures— startups. From the Founding Fathers in politics to the Royal Society in science to Fairchild Semiconductor’s “traitorous eight” in business, small groups of people bound together by a sense of mission have changed the world for the better. The easiest explanation for this is negative: it’s hard to develop new things in big organizations, and it’s even harder to do it by yourself . Bureaucratic hierarchies move slowly, and entrenched interests shy away from risk. In the most dysfunctional organizations, signaling that work is being done becomes a better strategy for career advancement than actually doing work (if this describes your company, you should quit now). At the other extreme, a lone genius might create a classic work of art or literature , but he could never create an entire industry. Startups operate on the principle that you need to work with other people to get stuff done, but you also need to stay small enough so that you actually can.

Positively defined, a startup is the largest group of people you can convince of a plan to build a different future. A new company’s most important strength is new thinking: even more important than nimbleness, small size affords space to think. This book is about the questions you must ask and answer to succeed in the business of doing new things: what follows is not a manual or a record of knowledge but an exercise in thinking. Because that is what a startup has to do: question received ideas and rethink business from scratch...

Thiel, Peter; Masters, Blake (2014-09-16). Zero to One: Notes on Startups, or How to Build the Future (Kindle Locations 129-411). Crown Publishing Group. Kindle EditionBracing. Get a copy. While every page is a delight, read the conclusion in particular.

___

apropos of healthcare business models, got this on my Atlantic iPhone app:

The Rise of the M.D./M.B.A. DegreeInteresting article. I am no big fan of the MBA degree (I once irascibly called it "a short bus degree for people who can't write a Thesis"). The fact that U.S. healthcare is such a byzantine, expensive mess is to a significant degree the doing of MBA thinking.

At a time when many of healthcare's greatest challenges are business problems, more and more doctors are adding three extra letters after their names.

VIDYA VISWANATHAN SEP 29 2014

For David Gellis, the spark came during a class in college on health policy in America. He had known he wanted to become a doctor, but he was looking for a way to contribute to systemic change in healthcare. His professor at the time was Donald Berwick, who later headed the Center for Medicaid and Medicare Services and made a bid this year to be the Democratic candidate for governor of Massachusetts on a platform that includes single payer healthcare. Berwick’s class inspired Gellis to think more about the business skills needed in healthcare.

Gellis decided he wanted to apply business skills specifically to primary care, and he applied to Harvard Medical School and Harvard Business School simultaneously. By the time he began his residency in internal medicine, he’d completed both degrees and had caught the attention of Iora Health, an innovative primary care practice that was planning to start up in a few cities around the country. When he finished his residency three years later, the company hired him as a primary care provider. Half a year later, he is helping to lead their Brooklyn practice.

“I have an actual management title and responsibilities, which is pretty crazy six months out of residency,” said Gellis.

According to Maria Chandler, who is president of the Association of M.D./M.B.A. Programs and herself a recipient of both degrees, the degree combination “fast tracks” graduates up the career ladder. The current nominee for surgeon general, Vivek Murthy, holds both degrees, has founded multiple organizations, and is only 36 years old.

Those with dual degrees have a particular edge when it comes to hospital administration, a field that has traditionally employed M.B.A.s as leaders and M.D.s as middle managers. According to a New York Times analysis in May, the average annual salary for a hospital administrator is $237,000, compared with an average of $185,000 for a clinical physician. A 2011 study found that hospitals with physician CEOs outperformed those with non-medical leadership.

“Just like you wouldn’t want a school superintendent to never have taught, you don’t want the person leading your hospital to never have taken care of a patient,” said Vinod Nambudiri, a fifth-year internal medicine and dermatology resident at BWH and a graduate of Harvard’s joint M.D./M.B.A. program. Chandler wonders how physicians can become administrators without business training. “What industry puts somebody with no business training in front of a huge budget?” said Chandler. “Nowhere but medicine, really.”...

During my credit risk management days, I worked in a department full of them. We had one econometrician, two statisticians (one of whom, my underachiever bud Ezra, also had an MBA and two undergrad degrees), me, the liberal arts "Ethics" guy, and about 10 MBAs. Our MBAs were smart, collegial people, but they typically had a relatively narrow paradigimatic focus.

INTERESTING "INNOVATION" TIDBIT

For many years, researchers and industry observers have conjectured that rising generic penetration might have an impact on the rate and direction of pharmaceutical innovation. Using a new combination of data sets, we are able to estimate the effects of rising generic penetration on early-stage pharmaceutical innovation. While the overall level of early-stage drug development has continued to increase, generics have had a statistically and economically significant impact on where that development activity is concentrated and how it is done. In the full sample, we find that, as our baseline measure of generic penetration increases by 10% within a therapeutic market, we observe a decrease of 7.9% in early-stage innovation in that market. This implies that drug development activity is moving out of markets where generic competition is increasing and into domains where it is relatively less intense.From The Incidental Economist.

CODA

Science is complicated. Simple concepts that appear at first to be obviously true or untrue usually turn out to be more nuanced than we thought. Newtonian physics was taken as “the truth” until we learned in the 20th century that it didn’t apply on cosmological or subatomic scales. Medicine and human physiology are more complicated than most people realize or want to believe.From Science Based Medicine.

...I spoke with one of the best statisticians at Harvard, Alan Zaslavsky, about the case. This is why we need to adjust quality measures for socioeconomic status (SES), he said. I’m worried, I said. Hospitals shouldn’t get credit for providing bad care to poor patients. Mr. Jones had a real readmission – and the hospital should own up to it. Adjusting for SES, I worried, might create a lower standard of care for poor patients and thus, create the “soft bigotry of low expectations” that perpetuates disparities.From THCB, Changing My Mind on SES Risk Adjustment

___

More to come...

No comments:

Post a Comment