Yeah, right.

|

Trust THIS ReviewI was settling in to study the new 824 pg book "The Big Myth" by science historians Naomi Oreskes and Erik Conway for my blog when Will Sommer's new book "Trust The Plan" came to my attention. I read the Amazon "Look Inside" sample. Intrigued, I downloaded it and read it carefully overnight. I tweeted the author that "Chapter 7 alone was worth the price." Mr. Sommer delivers a fine, enjoyable writing style, and—notwithstanding that he's a journalist, not a social psych practitioner—provides astute analytical evaluations of the phenomena comprising the fevered, impenetrable conspiratorial illogic which hobbles a disturbing percentage of humanity (abetted by the new comms wrinkle of digital social media). As a (now-retired) long-time statistical analyst and former forensic radiation lab programmer who did a lengthy adjunct stint teaching collegiate Critical Thinking and Argument Analysis, I have an abiding concern over the bozo cognitive muddles and antics characteristic of "QAnon" and the broader cohort of the "SERIOUSLY?" demographic. I joke that "Occam's gonna need a bigger chainsaw."

The joke is increasingly not funny. I've certainly had my exasperated mocking sport with these myriad, poignant Legends In Their Own Minds across the years, but some of them increasingly threaten or engage in armed violence, not only against the hated "State" but also anyone who individually pushes back on their noise.

"Trust The Plan" is well worth your time. Trust Me. It was for me. I don't have a "Plan," just a candid reading recommendation.

When I wrote and submitted the review (still pending as I post this), the only prior text review posted was a pissy 1-star Trump troll screed.

"Ridiculous" (Chris Long)Untraceable dude obviously did not read the book.

First of all, there IS no such entity as “QAnon.” This is literally a mainstream media construct. So, the author is off to a very poor start just from the title alone.

Secondly, the book description says it all: “Trust the Plan shows us in granular detail who we’ll be up against for years to come.” So what we have here is yet another anti-Trump diatribe.

No thanks.

TRUMP 2024!

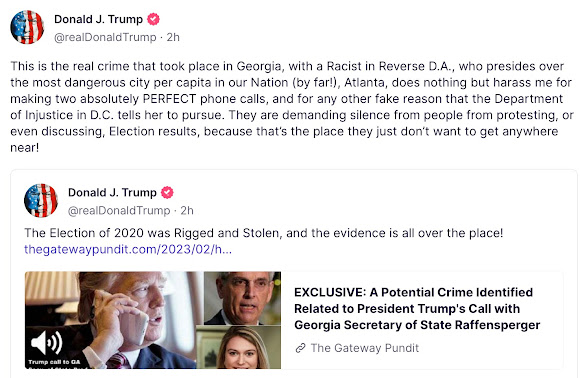

SATURDAY UPDATE

Amazon posted my review, along with this beaut.

The SERIOUSLY? demographic.

ERRATA

Ohhhh, Canada...

Yeah, I know, we're admonished to "be civil" to these careening Dramatists. They're "hurting," and simply acting out in response to feeling "neglected" by us mainstream society "normies" and the overlord globalist "elites."

I guess.

Oh, props to Will for noting the history of the "Where We Go One We Go All" thing. It's from the awesome 1996 Jeff Bridges sailing movie "The White Squall." Totally loved that flick.

BULWARK INTERVIEW WITH THE AUTHOR

I have a singer-songwriter-keyboardist friend from Oregon, a devout evangelical Christian by the name of Doug Brons. He's fabulous. I've called him "the Michael MacDonald of Christian rock." In the last year or so, though, he's started posting weird QAnon-ish stuff on Facebook, making dark allusions to "the Coming Storm" and the "WWG1WGA" thing. Check out his recent song "We Are The Patriots."

OK, then...

_____

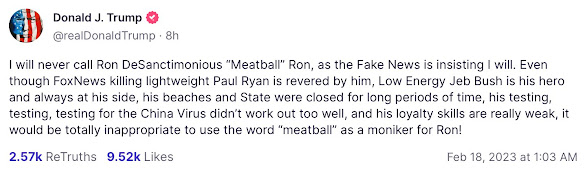

Oh, yo, hey Mr. "Chris Long" Trump 2024, a little quickie BobbyG Photoshop erratum for you:

Eloquent, as always. Original tweet here (unless they pull it).

I posted it on Facebook. One of my FB friends assumed it was a spoof. "Dude, I transcribed it verbatim from the audio clip put up on Twitter by his spokeswoman, then pilfered that "coin" image via Google and quickly glommed the whole thing together in a jpeg, using Photoshop."

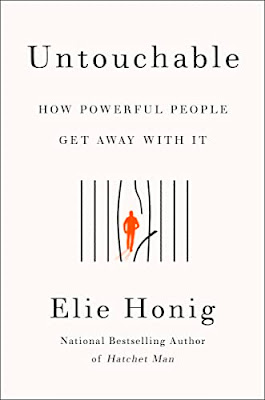

IN THE MAIL TODAY

My new Harper's arrived. Back cover, full bleed ad:

I got the Kindle edition Tuesday when it was released, and am burrowed well into to it. First cited it here.

This is the story of how American business manufactured a myth that has, for decades and to our detriment, held us in its grip. It is the true history of a false idea: the idea of “the magic of the marketplace.” Some people call it market absolutism or market essentialism. In the 1990s, George Soros popularized the name we find most apt: market fundamentalism.1 It’s a quasi-religious belief that the best way to address our needs—whether economic or otherwise—is to let markets do their thing, and not rely on government. Market fundamentalists treat “The Market” as a proper noun: something unique and unto itself, that has agency and even wisdom, that functions best when left unfettered and unregulated, undisturbed and unperturbed. Government, according to the myth, cannot improve the functioning of markets; it can only interfere. Governments therefore need to stay out of the way, lest they “distort” the market and prevent it from doing its “magic.” In the late twentieth century, market fundamentalism was cloaked in the seemingly ancient raiments of received wisdom. In fact, it was more or less invented in the twentieth century.

Classical liberal economists—including Adam Smith—recognized that government served essential functions, including building infrastructure for everyone’s benefit and regulating banks, which, left to their own devices, could destroy an economy. They also recognized that taxation was required to enable governments to perform those functions. But in the early twentieth century, a group of self-styled “neo-liberals” shifted economic and political thinking radically. They argued that any government action in the marketplace, even well intentioned, compromised the freedom of individuals to do as they pleased—and therefore put us on the road to totalitarianism. Political and economic freedom were “indivisible,” they insisted: any compromise to the latter was a threat to the former—any compromise at all, even to address obvious ills like child labor or workplace injury. Why did we ever come to accept a worldview so impervious to facts? A worldview Smith himself, often thought of as the father of free-market capitalism, would have rejected? This book tells that story...

Oreskes, Naomi; Conway, Erik M.. The Big Myth (pp. 10-11). Bloomsbury Publishing. Kindle Edition

CONCLUSIONI recall my nano-bit part in the 2008 financial crash run-up.

Judge Richard A. Posner is one of America’s most distinguished conservative jurists and for many years a leader of the law and economics movement. This movement, which originated at the University of Chicago, holds that the law is best viewed as a tool to promote economic efficiency and that economic analysis can and should can guide legal practice.1 Posner spent most of his career displaying a jaundiced view of government regulation and he influenced many a young jurist to do the same; one analysis finds him to be the most cited law writer of the second half of the twentieth century. His jurisprudential philosophy—which substantially equated justice with economic efficiency—provoked one critic to snarl that “Maximum Wealth, badly distributed, does not lead to maximum happiness.”

In 2009, Posner undertook an analysis of the 2008 financial crisis, which caused him to rethink his views. A “rational decision-maker starts with a prior probability,” Posner wrote in A Failure of Capitalism: The Crisis of ’08 and the Descent into Depression, “but adjusts that probability as new evidence comes to his attention.” The near collapse of the world’s banking system offered a raft of evidence about the reality of market failure and the need for government regulation, particularly in financial markets. “Behavior that generates large external costs,” he tartly observed, “provides an apt occasion for government regulation.” What he had learned from the crisis was that “we need a more active and intelligent government to keep our model of a capitalist economy from running off the rails. The movement to deregulate the financial industry went too far by exaggerating the resilience—the self-healing powers—of laissez-faire capitalism.” The responsibility for building the guard rails that capitalism has proven itself to require has to rest with government, because there isn’t any other institution to do it.

The 2008 collapse should have hit “economic libertarians in their solar plexus,” Posner observed, because the crisis was the result of underregulation, a consequence of the “innate limitations of the free market.” But if the economic libertarians were hit by the 2008 crisis, they refused to flinch. In conservative circles and the offices of K-street lobbyists, trade associations, and think tanks, and on the pages of the Wall Street Journal, as well as in much academic economics, free-market ideology remained largely in place… [pp. 567-568].

UPDATE: I'm now about halfway through "The Big Myth," which the Kindle app tells me is almost a 19 hour read. It is kickin' my butt. Stay tuned...

__________